What's the difference between a bookkeeper and an accountant?

Traditionally, it's thought that bookkeepers record the everyday transactions of the business, and accountants look at the bigger picture and handle tax and compliance. However, in 2022 with cloud accounting software such as FreeAgent, Quickbooks, Sage and Xero linking to HMRC to enable online filing, and the increase in bookkeepers with ICB Level 4 qualifications in tax and compliance, have UK bookkeepers become a hybrid? And what should a business consider when looking for their next accounts professional?

Training Link's Gary Hupston who has been training ICB bookkeepers for over 25 years says, 'Accountants and bookkeepers are now very much the same in terms of the services they can provide. Both should be able to carry out most tasks within the bookkeeping and accounting process.

'Bookkeeping forms the basis of the process where the transactions are recorded and sorted into the correct areas of the accounts. From here the accounting process takes over where the financial transactions and data are analysed and used for Year-End submissions and Tax Returns.'

What does a bookkeeper do?

Whilst a bookkeeper's core role has always included:

- recording transactions

- balancing the books

- reconciling the bank

- VAT Returns

- providing monthly reports on the business's financial position

ICB bookkeepers may also offer value-added services to help the business:

- accounting software set up and support

- setting up of daily systems and workflows

- business formation and company secretarial work (known as Trust and Company Services Provision)

Additionally, ICB bookkeepers may be qualified to carry out some of the tasks more traditionally associated with accountants and specialists:

- Payroll

- Corporation Tax

- Self Assessment Tax

- Financial Statements (for Companies House)

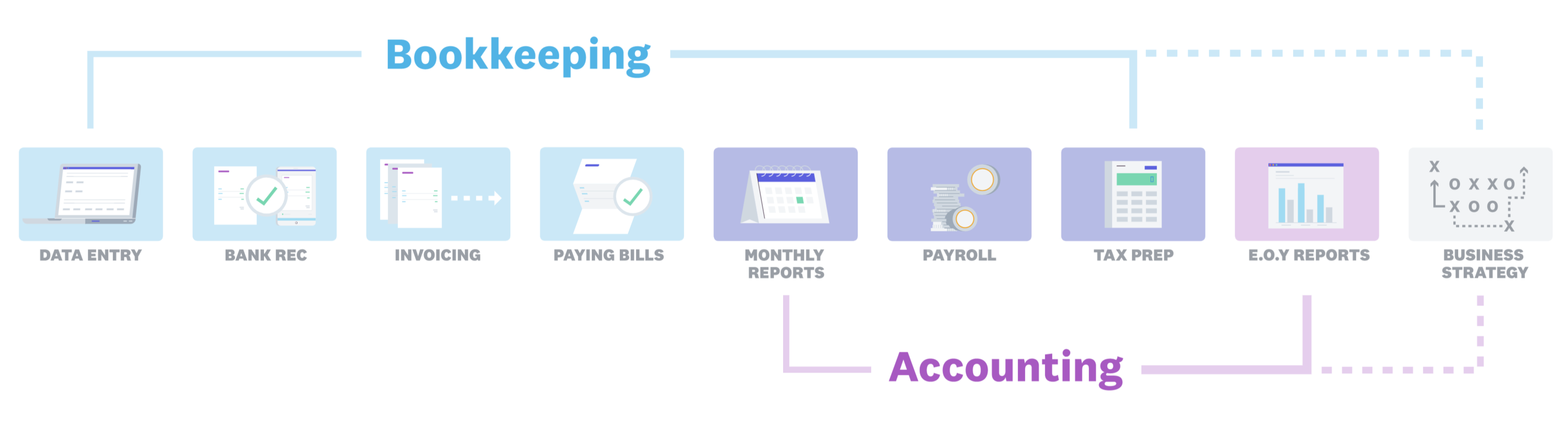

Xero, whose website states 'Hiring the right bookkeeper can make all the difference to your business,' illustrates how bookkeeping can be considered to span the entire accounting process.

Bookkeeping vs Accounting diagram reproduced by kind permission of Xero

Bookkeepers set up systems

Business owners, particularly when starting out, can often find it hard to set aside enough time every week to do the books. This means they can struggle to catch up and may forget key information or lose receipts. Bookkeeping errors can cost money if businesses miss out on reclaiming all the VAT they're entitled to, or miss key deadlines.

ICB bookkeepers are valued for bringing order to chaos by systematising the accounts function of a business and supporting businesses to get the most out of their accounting software. Bookkeepers will monitor day-to-day transactions and take care of digitising receipts, chasing invoices, filing VAT returns, etc.

Highly skilled and meticulous, bookkeepers can spot anomalies and opportunities and provide timely feedback and reconciled accounts to stressed-out business owners. Their attention to detail allows them to not just do the books but also help improve the efficiency of a business and bring much-needed clarity and reassurance.

ICB member and Social Media Influencer of the Year, Nicola Payne MICB PM.Dip, puts it this way, 'As bookkeepers, we are concerned with the details and love nothing more than to have the books completely reconciled to the penny! This is very beneficial to the business owner as they have accurate information with which to make important business decisions.’’

Bookkeepers do payroll

No employer can sleep at night without knowing that their team's salaries are accounted for. Doing the payroll is a vital task well-suited to a professional who is formally qualified in the ICB Level 3 Payroll Diploma or an ICB-assessed Payroll Apprenticeship at Levels 3 and 5. Nicola Payne says, 'Bookkeepers are great at payroll because it requires the level of detail that we thrive on, and despite adverts to the contrary, it can't be done properly by just anyone!'

But change is constant in payroll and professionals must remain up to date with ever-evolving rules, rates and allowances to ensure their employer and clients remain compliant. The monthly payroll segment of ICB TV, Wages Wednesday, hosted by Payroll Policy Adviser Ian Holloway, ensures that ICB members are up to speed and able to provide the best payroll service.

Bookkeepers are friendly and supportive

Business owners shouldn't be afraid to keep looking until they find an accounting professional that they actually like! A good bookkeeper is friendly and approachable and there to support the business. ICB bookkeepers and payroll agents pride themselves on being close to the numbers, but more importantly, understanding what those numbers mean to the people who run the business. Rather than checking-in once a year to get the accounts and tax return filed, bookkeepers are there for their clients every step of the way.

By bringing meaning to the numbers, de-jargonising the accounts function, and supporting their clients' and employers' ambitions, bookkeepers help businesses flourish. Bookkeepers care. Why wouldn’t a business owner want someone who is just as passionate about the success of the business as they are?

ICB member, Claire Allen C.FICB sums up the personal touch bookkeepers give to their clients;

'Nearly all my clients ring me up just because they want to have a chat, sometimes because they don’t have anyone else to talk to about their business. No one else knows their business as much as a bookkeeper. A bookkeeper is a close confidante, someone whom the client can trust. So, clients use us quite often as a sounding board, as a shoulder to cry on.'

Bookkeepers work closely with accountants

Whilst ICB Bookkeepers may be qualified to carry out the entire accounts function from basic bookkeeping and payroll through to tax and filing accounts, they're particularly adept at working synergistically with accountants. In a recent survey conducted by ICB, 64% of ICB Bookkeepers said that they are in touch with an accountant 'often' or 'very often', with less than 2% saying they never work with accountants. Bookkeepers enjoy collaborating with accountants to get the best results for their clients.

With 97% of surveyed ICB Bookkeepers saying they 'work harmoniously with accountants' some, if not all, of the time, and the majority saying working with accountants helps them run their practice, it's clear that the partnership isn't just good for the client but can also be good for the bookkeeper.

ICB member, Kirsty St. John C.MICB PM.Dip says, 'I enjoy the day-to-day problem-solving; answering queries and matching up odd, stray amounts. But I like working with accountants because they have the overall picture of the year's figures without getting stuck in the detail. They provide me with reassurance when I hand over the books and they deal with the taxman.'

Why every business needs a bookkeeper

Good bookkeeping is a vital component of a successful business. Bookkeeping overlaps and complements the work carried out by accountants, and some businesses may only need a bookkeeper. That said, most bookkeepers work together with accountants to ensure the best possible outcomes for the business:

- ICB bookkeepers are highly skilled and are qualified to look after sole traders, and micro and small businesses on a day-to-day basis. Bookkeepers enjoy keeping the accounts accurate and tidy. Bookkeepers can explain the accounts in a straightforward way, and offer advice on short and medium-term issues such as outstanding invoices and cashflow. ICB bookkeepers can be qualified to help with payroll, year-end tax and financial reporting.

- Accountants use the accounts prepared by the bookkeeper to provide advanced tax and business advice, perhaps on a quarterly or annual basis. Accountants may make adjustments, prepare tax returns, financial statements, and year-end reports. Accountants often have a wide range of high-level qualifications, gained over a number of years, and can offer specialist advice on complex business issues.

Business owners should be aware that both bookkeepers and accountants are required to be registered with an appointed Anti-Money Laundering Supervisor and they should check this before they engage their services.

The modern-day role of a bookkeeper involves much more than simple data entry. ICB bookkeepers are highly-skilled, detail-orientated, digital-savvy, and critical to a business's success.

Read the full results of our survey here

If you are thinking of employing or outsourcing to a professional bookkeeper, you can search our directory or post a vacancy for free:

> Find a Bookkeeper

If you would like to join ICB, either as a student or a professional member, please visit:

> Membership

You can also call us on 0203 405 4000 - we're open Monday - Friday, 8:30am - 5:30pm