Why it’s brilliant (and how to make it even better with Adfin)

Every bookkeeper has felt the pain of late payments, manual chasing, and the awkward “just bumping this to the top of your inbox” emails. Direct debit is brilliant at fixing much of this - it means less chasing, more predictable payments and better cash flow.

At the same time, as with any payment method, there are always a few things to watch out for (direct debit has been around for 30+ years after all!). We’ll dig into what bookkeepers should bear in mind when getting paid with direct debit - and what we’ve built at Adfin to make it even better.

Why direct debit is great for bookkeepers

Reliable cash flow. Once a client signs a mandate, collections run like clockwork. Invoices get scheduled for collection on the due date (wherever possible), so you know when the money will land in your bank account. For bookkeepers managing dozens of clients, that predictability makes a huge difference.

Better client experience. Clients don’t need to remember to pay every month. It’s one quick mandate, then they’re done - and they still get clear notice before each collection. Direct debit also helps your clients’ cash flow as well as your own - making regular bookkeeping fees simple and predictable for clients.

Flexible amounts. Once a mandate is signed, you can invoice for varying amounts. This makes direct debit ideal for bookkeepers who charge based on workload or number of transactions. If the price changes, all you do is update the invoice (and no need for your client to do anything at all).

Hear it from Nicola from Accounts and Tax Made Easy:

I wanted to switch to direct debits. I tried GoCardless, but it wasn’t easy to set up. Then I found out about Adfin and moved all my self-assessment clients onto monthly direct debits. Now I do the invoices in Xero, and Adfin sends them out. It’s just so much easier. They even chase when the mandate needs signing for new clients!

What to watch out for (and how Adfin helps)

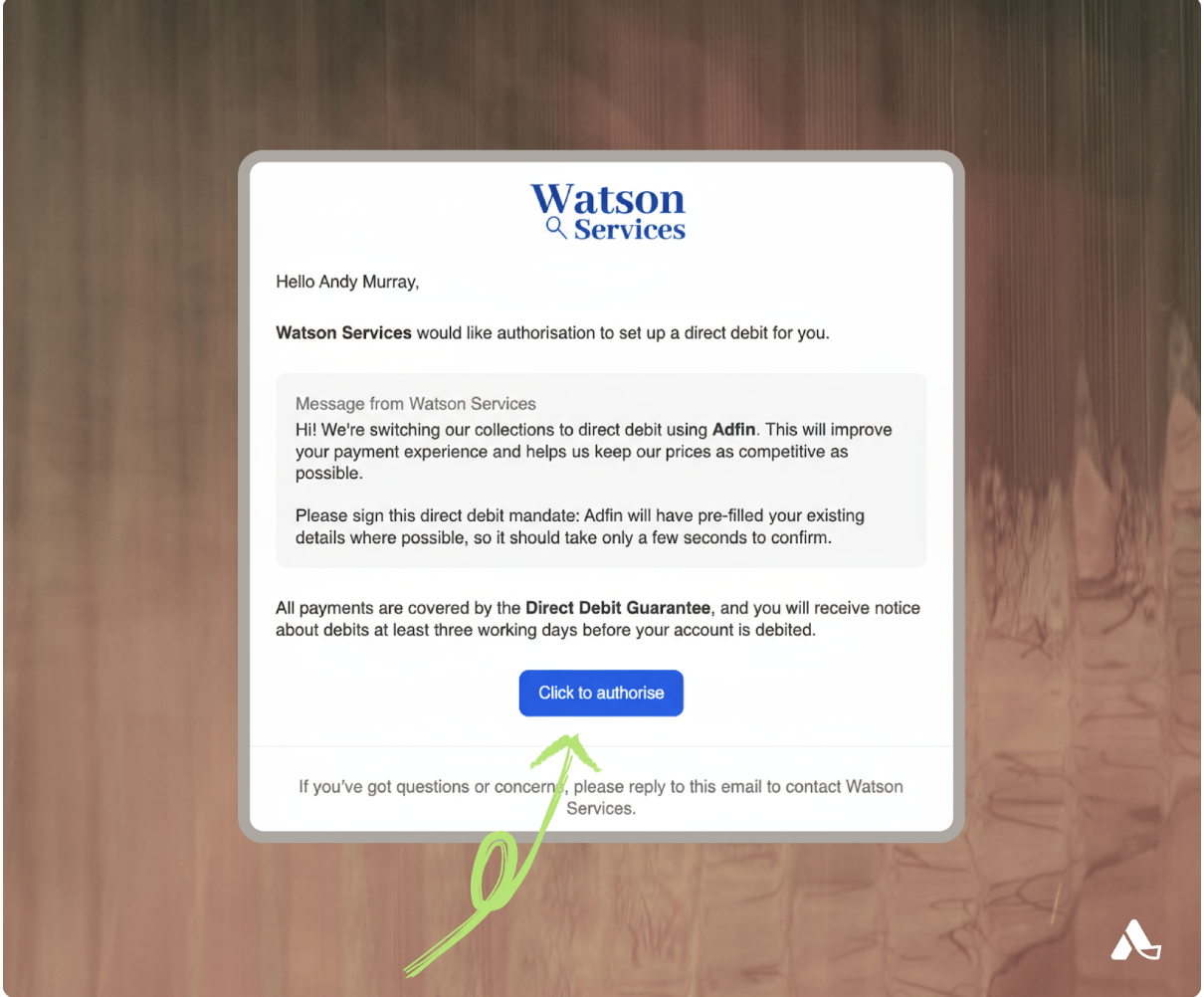

Your client needs to sign a direct debit mandate. This authorises you to take payments from their account. Many bookkeepers include a direct debit mandate as part of their client onboarding, so payment collection is sorted from day one.

How Adfin helps: Adfin enables you to bulk‑send mandate requests and track who’s signed them. You can include a custom message along with your mandate request to explain in your own words to clients what’s happening. We’ve even built integrations with leading practice management tools like Engager and Socket, so you can send direct debits directly from those platforms.

Include a custom message with your mandate so your clients know what's happening

Collection timings are set by the scheme. Direct debit isn’t instant; clients get advance notice and funds settle a few working days after the due date.

How Adfin helps: If you’re not sure when to set your due date so money lands when it needs to, you can choose a target settlement date instead in Adfin, and we’ll work backwards to when to debit your client.

Pick your target settlement date so you know when funds will land in your bank account

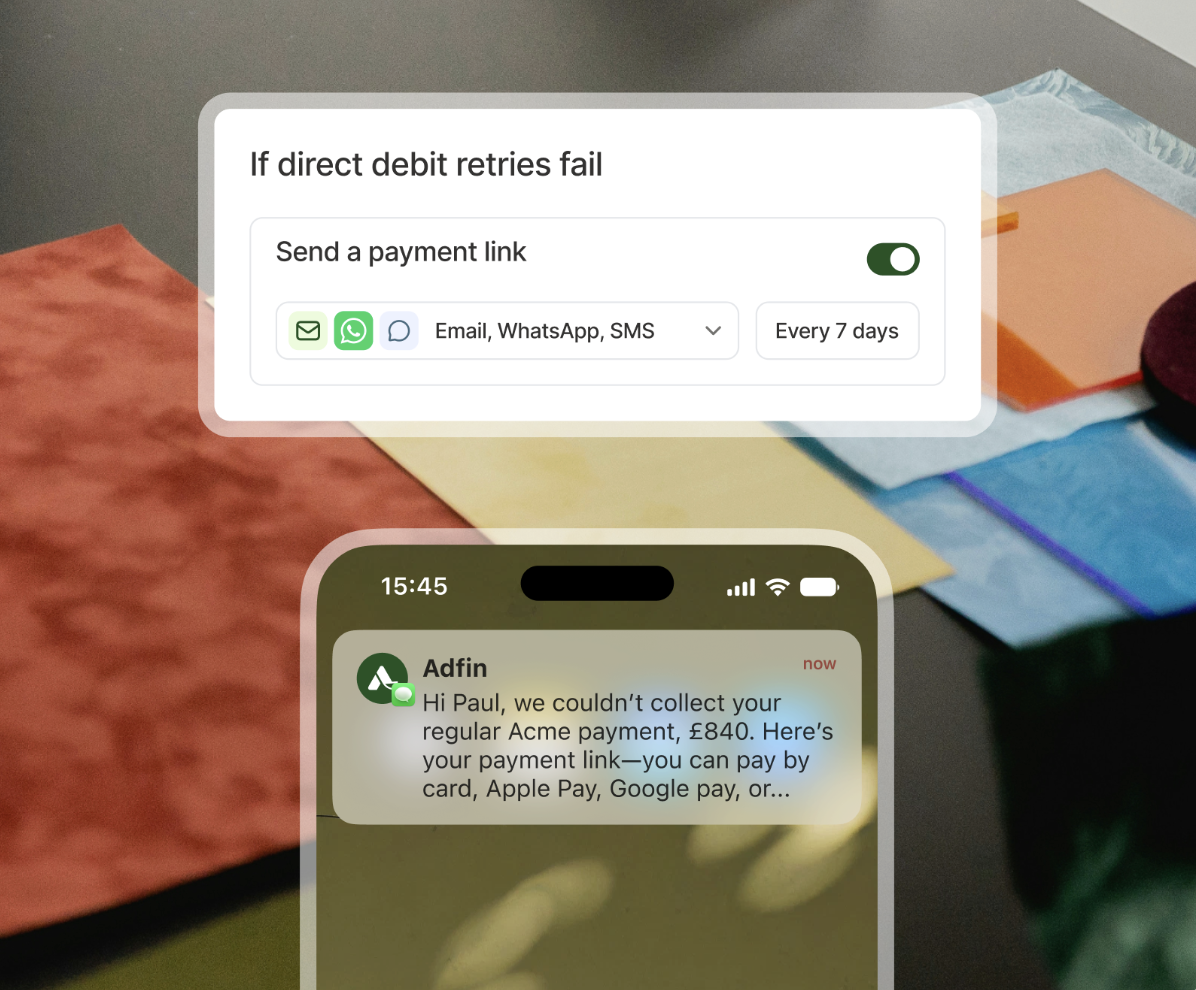

Occasional payment failures. Insufficient funds or account issues do happen.

How Adfin helps: Adfin doesn’t charge for failed payments (unlike some other providers). If you don’t get paid, nor do we! If a payment does fail, we make sure you have a fallback - choose how many times you want to retry, or switch automatically to an instant option (card, pay by bank, Apple Pay, Google Pay).

Customise how often you retry failed payments and when to switch to an instant option

Reconciling bulk settlement. Keeping track of your direct debit payments can be difficult when they are settled in bulk: since direct debit payments are settled in a single payout from your provider, it can be difficult to reconcile this to invoices in your accounting software.

How Adfin helps: Adfin integrates with Xero and QuickBooks, and will automatically mark invoices as paid when we settle funds to you. We also provide you with a granular breakdown by payout of exactly which invoices were paid, so you'll never have to spend time figuring out what was or wasn't paid.

Client recognition matters. If a client doesn’t recognise your payments on their bank statement, they’re more likely to query these, or even raise a chargeback with their bank.

How Adfin helps: With Adfin Custom, your business name appears on the bank statement to help clients recognise you at a glance, reducing the risk of disputes.

Already using another direct debit provider?

Like what you’re hearing about Adfin, but already using someone else? It’s easier than you think - we’ve built products to migrate over all your invoices and mandates smoothly. With our mandate migration offering, clients don’t even need to sign new mandates - we’ll move them from your old provider with no interruptions to collections and no paperwork.

Get started with Adfin direct debit

Direct debit takes the friction out of getting paid, but the details matter. With Adfin, you get the reliability of direct debit with the added safety net of customised retries, instant fallbacks, and clear client comms - all tied into your existing accounting tools.

Want to give it a try?Book a demo or sign up today to join the bookkeepers already using Adfin to make payments stress-free.